Schedule a Discovery Call

Sonos Capital, LLC was formed to:

Offer better operational efficiency resulting in lower costs and higher returns

Offer better administrative efficiency resulting in lower costs and higher returns

Obtain a debt structure which is more attractive and beneficial to investors

Offer increased diversification to the benefit of our investors

Why Sonos May be Right for You

Manufactured homes present a fantastic investment opportunity as the market is highly fragmented with plenty of room for consolidation across the US. One of the primary value drivers is that while the community residents typically own their home, the property itself is often located on rented land. In recent years, private investment into this market has increased, with zoning laws and property restrictions making it increasingly difficult to create new communities.

Sonos Capital specializes in acquiring and managing mobile home communities, a resilient and cash-flow-generating real estate asset class. We focus on providing stable, asset-backed investment opportunities with predictable returns, meeting the growing demand for affordable housing while ensuring consistent cash flow for our investors.

Our approach emphasizes long-term value creation by targeting high-potential properties in key markets. Using industry expertise, data-driven strategies, and hands-on management, we unlock the full value of each community, enhancing resident experiences and maximizing investor returns.

With a commitment to transparency, integrity, and sustainable growth, Sonos Capital has a proven track record of success. We are a trusted partner for investors looking to diversify their portfolios in one of the most stable and profitable real estate sectors.

$

Investments For Income

Between low interest rates and high market volatility, investing for income has become increasingly challenging. Sonos Capital Fund 2 allows investors to capitalize on a niche market segment offering outsized returns.

The Creation of Value

An investment in Sonos Capital Fund 2 presents us with an opportunity to build partnerships with each of our investors, both for this fund and the opportunities that are expected to follow.

Long Term Investor Partnerships

We use lean systems for property management and programs for aggressive optimization in order to create value for our investors. We have found that this is a better strategy than trying to time market factors or hoping for blind luck.

About investing in Manufactured Home Parks

Manufactured Housing Communities Offer Tremendous Investment Potential! Manufactured homes are one of the most affordable housing options there is, and because of this known fact there are manufactured housing communities in almost every city and state across the USA. While the community residents typically own their home the property that the home is situated on rented land.

Private investment in manufactured housing communities has been rising for years. Since zoning laws and property restrictions make it difficult to create new manufactured housing communities any new competition in the future for this area of the housing market is almost nonexistent.

Fund Terms and Returns

$1 Million minimum offering amount

$10 Million maximum offering amount

$50,000 minimum investment

Term: Up to 6 years

Quarterly Distributions

Cash Investment, Self Directed IRA and other retirement account options may be used

Reg D, Rule 506(C) Offering to Accredited Investors Only

Limited number of investors

Investor Advantages to Consider With Sonos Capital, LLC

Income

Stability

Market dependability as MHC's have verifiably shown a low relationship to the more extensive market. Moreover, occupant security and life span because of "stability" of manufactured houses lead to more prominent consistency of pay when contrasted with other resource classes.

Tax

Benefits

Accelerated Depreciation is leveraged under "land upgrades" (15 years versus 27.5 years for most private land). This strategy can increase project-level returns and sometimes provide additional tax benefits to investors.

Is This Investment Right for Me?

Only you can decide whether an investment in Sonos Capital, LLC is right for you or not. Every case and situation is different and unique, and you need to consider all of the relevant and important factors in your case before you make any investment decision.

Capital

Preservation

The Fund may offer broadening and security as it intends to obtain MHC's that produce solid income situated in different states. Likewise, the Fund is overseen by Key Principals who speak to a solid and experienced group in the MHC business.

When do I begin to accrue a return?

An investors account begins to accrue a return 30 days after the date of acceptance into the Fund.

When will distributions likely begin?

The goal of the Manager is to begin distributions at the conclusion of Q4 2021.

When are distributions made?

Distributions may occur on a quarterly basis and are typically distributed within 45 days after the close of a quarter.

What kind of reporting will I receive?

Quarterly you can expect to receive a brief fund update. Annually, you will receive a K-1, as well as an internally generated annual financial statements.

Are you a REIT

No.

Is the Fund eligible for a 1031 exchange?

No.

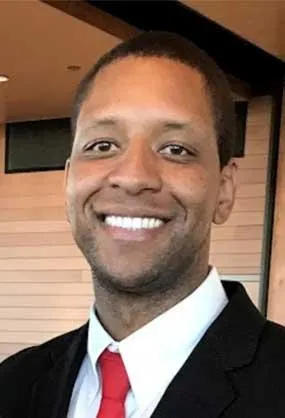

Walter Johnson

Founder & CEO

Mr. Johnson is a Finance Professional and Real Estate Investor/Syndicator with 16+ years of experience serving the Real Estate and Banking Industries. Over the years, he has served in various capacities from Real Estate Investor & Vice President to High Converting Banker & Sales Manager. He is adept at spearheading strong teams and creating robust business development plans. He is an avid seeker of knowledge who highly appreciates the notion of continuous improvement and aspires to become an industry leader. Driven by the desire to influence and impact other’s lives for the better, he is passionate about inspiring the generations of today and tomorrow to strive for long-term business success and prosperity.

Dayna Corlito

Controller /

Operations

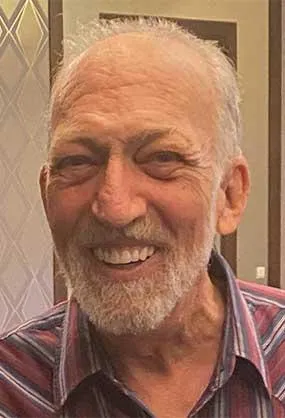

Mike Taylor

Community

Development

Michael Newman

Capital

Advisor

Neal Haney

Occupancy

Advisor

CONTACT US

Please complete the contact form and we will get back to you about any questions you have about our offering.

Sonos Capital - 4343 N. Scottsdale Road Suite 150 - Scottsdale, AZ 85251 — [email protected] — (480) 674-2035

IMPORTANT MESSAGE: This website is a website owned and operated by Sonos Capital (“Us/We/Our/Company”). By accessing the website and any pages thereof, you agree to be bound by the Terms of Service, Privacy Policy , and Disclosures, as each may be amended from time to time. We are not a registered broker, dealer, investment advisor, investment manager or registered funding portal. Prospective investors are advised to carefully review Our private placement memorandum, operating agreement and/or partnership agreement, and subscription documents (“Offering Documents”) and to consult their legal, financial and tax advisors prior to considering any investment in the Company, one of its subsidiaries or affiliates. Sales of any securities will only be completed through the Company’s Offering Documents and will on be made available to “Accredited Investors” as defined by the Securities and Exchange Commission (“SEC”). Generally, an Accredited Investor is a natural person with a net worth of over $1 million (exclusive of residence) or income in excess of $200,000 individually or $300,000 jointly with a spouse. The securities are offered in reliance on an exemption from the registration requirements of the Securities Act of 1933, as amended, and are not required to comply with specific disclosure requirements that apply to registration under the Securities Act. Neither the SEC nor any state regulator has reviewed the merits of or given its approval to the securities, the terms of the offerings, or the accuracy or completeness of any offering materials. The securities are subject to legal restrictions on transfer and resale and investors should not assume they will be able to resell their securities. All forward-looking statements address matters that involve risks and uncertainties and investors should be able to bear the loss of their entire investment. All investors should make their own determination of whether or not to make any investment, based on their own independent evaluation and analysis. Past performance is not indicative of future returns or Fund results. Individual investment performance, examples provided and/or case studies are not indicative of overall returns of the Company. In addition, there can be no guarantee of deal flow in the future. Forward looking statements are not statements of historical fact and reflect the Company’s views and assumptions regarding future events and performance.

All Rights Reserved Sonos Capital 2024